Entrepreneurial activity is characterized by the absence of certain limits in making payments in cash. Unlike an individual entrepreneur from a legal entity, his obligations do not include opening a current account and making a seal, while this is considered a prerequisite for the existence of a legal entity. Another difference, which at the same time is an advantage, can be considered the absence of a requirement to have constituent documents. An individual entrepreneur is invariably the only person who owns all the rights and income received. Thus, the solution to the dilemma "is the IP legal entity or not?" quite obviously: NO. However, when implementing entrepreneurial activity in no case should one ignore the fact that an individual entrepreneur owns the powers of a legal entity. Video: who is the IP (29 votes, average: 4.20 out of 5) Loading…

Online journal for an accountant

IP as a physical person (of the same car, apartment, land) even if this property was not used in business activities.

- An individual entrepreneur is obliged to pay taxes in a timely manner in accordance with the chosen form of taxation, as well as to make mandatory contributions to the FIU.

- If there are employees, the individual entrepreneur is obliged to act as their tax and insurance agent and pay for them to the appropriate budget funds.

- In cases of litigation against persons with legal status individual entrepreneur, the first thing to do is to determine in what capacity the citizen acted at the time of the offense - as an individual entrepreneur or as individual.

IP - an individual or a legal entity? is the IP a legal entity?

Entrepreneurs are subject to certain restrictions. Back to Table of Contents ○ What does the IRS say? From the point of view of tax legislation, individual entrepreneurs are individuals with a special status.

However, the Federal Tax Service provides for IP preferential systems taxation with minimal reporting. Individual entrepreneurs on a special account. Separate rules and regulations are developed for them.

Info

Back to Table of Contents ○ Legal advice: ✔ Can an individual entrepreneur be transformed into a legal entity? There is no direct prohibition on transformation in the legislation, that is, this is allowed. To do this, you must contact the territorial office of the Federal Tax Service and submit the relevant documents.

✔ Can an individual do business without opening a sole proprietorship or LLC? It is legally prohibited to conduct commercial activities without registration.

Is an individual entrepreneur a legal entity or an individual?

Permanent documentary traffic control Money, mandatory opening of a bank account Disposes of profits at his own discretion The head has no right to withdraw the proceeds received Cannot engage in any type of activity No restrictions on activities Pays contributions to the PFR, even if there is no profit There is an opportunity not to pay contributions to the PFR in the absence of income It is impossible to sell a business There are no prohibitions on selling a business Lower penalties High fines in case of violations of the Tax Code of the Russian Federation It is impossible to attract investors The possibility of attracting investors Thus, each of the legal forms has its pros and cons s, and any acting individual entrepreneur can register an LLC by contacting the Federal Tax Service with documents, but you will have to pay taxes and fees for all forms of activity.

Is it an individual or a legal entity?

- An individual entrepreneur is a specific person, a legal entity is an organization.

- Registration of a person as an individual entrepreneur is carried out at the place of permanent residence, and a legal entity is registered at the legal address.

- An individual entrepreneur operates independently, a legal entity is a team of people (however, both of them can be employers).

- The property of the organization and its founders is separated from each other, the individual entrepreneur, in turn, is liable with all his property, as an individual.

- IP does not have its own name.

- A legal entity is required to have a seal and a bank account, for individual entrepreneurs, both are advisory in nature.

- The activity of a legal entity is impossible without the availability of statutory documents.

Organizations have the right to commercial activity in any area that does not contradict the law.

Legal status of the entrepreneur: is the SP an individual or a legal entity?

Attention

In fact, an individual and an individual entrepreneur have many common features. However, conducting certain types of entrepreneurial activity without registration is not allowed.

We will tell you what are the similarities and differences between an individual entrepreneur and an individual. ✔ Common signs. TO common features include the following facts:

- Legally, individual entrepreneurs and individuals are equal.

- This is a specific person with a full name and identification number.

- The place of permanent registration is the same.

- An individual entrepreneur can act as a citizen when concluding transactions.

- An individual and an individual entrepreneur have the right to conduct business operations, conclude transactions, draw up Required documents and take legal action.

- In the event of a debt, individuals and individual entrepreneurs are liable with the property they own.

From the point of view of legislation, an individual entrepreneur is the status of an individual.

Legal status of an individual entrepreneur

Today, registering an individual entrepreneur implies the obligation to keep cash books with a clear indication of the receipt and expenditure of funds, similar to legal entities. They are required to file tax returns.

If a citizen registered as an individual entrepreneur receives income as an individual (for example, from renting or selling housing), he will have to submit two declarations - one as an individual, the other as an individual entrepreneur, indicating income from entrepreneurial activity. Tax office checks individual entrepreneurs in the same way as legal entities. The same applies to other regulatory bodies. An individual entrepreneur reports to the labor and fire inspectorates, the Committee for the Protection of Consumer Rights and numerous other authorities. About hired labor An individual entrepreneur has the right to attract hired workers, to make entries in work books.

IP - is it an individual or a legal entity?

Consideration controversial situations in court In accordance with the Arbitration Procedure Code of the Russian Federation, the Arbitration Court has the right to accept applications from organizations and individual entrepreneurs in the event of the following disputes:

- Economic: for example, about debts.

- Administrative: when conducting a business that is not legally registered.

- Organizational: bankruptcy of LLC.

- Tax: failure to pay advance payments on time.

- Corporate: when causing losses caused by co-founders, founders and participants to a legal entity.

- International economic: in case of default by a company registered on the territory of the Russian Federation in relation to a foreign citizen, or vice versa.

When issuing a decision on the imposition of penalties, the court has the right to be guided by data on the personal property of an individual entrepreneur.

Is this a legal entity or an individual? How does the law and the tax authorities answer this question?

However, it is absolutely wrong to believe that entrepreneurs have the status of a legal entity, because the Civil Code of the Russian Federation provides information that an individual entrepreneur is an individual who has the right to conduct entrepreneurial activities. Moreover, the equivalent of the concept of IP is the term "entrepreneur without a legal entity", which was used in all legislative acts at the beginning of the current century.

Each person can start doing business and get the status of an individual entrepreneur, and for this he does not need to own an office, and the place of registration of an entrepreneur can be his place of residence. Even if you are not registered in the prescribed manner and within the prescribed time as an individual entrepreneur, but you are engaged in entrepreneurial activity, then in this case you are also considered an individual entrepreneur, as stated in paragraph

2 tbsp. 11 h. 1 of the Tax Code of the Russian Federation.

IP - an individual or a legal entity?

As you know, in a commercial organization, income is paid only once a quarter in the form of dividends. In this important issue, an individual entrepreneur, without any doubt, enjoys much more freedom compared to a legal entity.

From a legal point of view, registration of an individual entrepreneur does not oblige him to keep accounting records and without fail to open a bank account for doing business. Such an entrepreneur can settle in cash (of course, observing all legal norms).

Although in practice today this practically does not occur. On fines and seals Another important difference relates to the amount of fines that inevitably occur due to errors in the maintenance and official execution of business documents.

Penalties for such violations, voluntary or involuntary, are very substantial.

The Civil Code states in black and white: “An individual entrepreneur (IP) carries out his activities without forming a legal entity (legal entity).” But why, in this case, the question is increasingly heard: “Is an individual entrepreneur an individual or a legal entity?”. Is it really all about our flagrant legal illiteracy? About problems and confusion It turns out that everything is not so simple. The reason for the emergence of such doubts is that the same Civil Code, after determining the individual entrepreneur, almost immediately reports that the same provisions and rules that regulate the activities of legal entities apply to its activities. Often, the tax authorities impose requirements on entrepreneurs that are similar to the requirements for commercial organizations.

However, there is still a difference between these concepts. ✔ Distinguishing features. The difference between an individual entrepreneur and an individual lies in the system of income taxation and the permissible field of activity.

For example, an individual with the status of an individual entrepreneur cannot be an employee and at the same time conduct entrepreneurial activities. A person, being an individual entrepreneur, can be an employee, but as an individual.

Many types of commercial activities are not available to an individual who does not have the status of an individual entrepreneur. So, for example, he cannot open a pavilion and sell any goods there or engage in the provision of household services population. Back to Table of Contents ○ Comparison of sole proprietorship and legal entity. Quite often you can find the identification of the status of an individual entrepreneur and a legal entity. This is not entirely correct from the point of view of legislation, but nevertheless, there are certainly similarities between these statuses.

Entity - an organization that has separate property and is liable for its obligations may, on its own behalf, acquire and carry out civil rights and bear civic obligations, be a plaintiff and a defendant in court.

Examples immediately come to mind, a business firm or government agency. However, when we want to define this concept precisely, we need to indicate a number of important, characteristic properties of it.

The main features of a legal entity:

- At the very beginning of its activity, it is obliged to undergo state registration.

- It has a name under which it operates.

- This is not just a team, but an organization with a clearly defined structure and management bodies.

- A legal entity must have its own address.

- When it is formed, constituent documents are adopted, on the basis of which all further activities take place.

- A legal entity must necessarily keep its books and pay taxes determined by law.

- It is obliged to obey the rules that are established by supervisory authorities (such as a firefighter, for example).

- The activities of a legal entity are determined by laws and regulations operating in the territory Russian Federation.

- A legal entity has a property isolation (its own property, the ownership of which is protected by law).

- It also provides for the liability that it may bear in case of failure to fulfill its obligations.

- He has the right to act on his own behalf in the civil law field and speak in court proceedings.

Individual: general information

Individual - citizen, a person participating in economic activity, acting as a full-fledged subject of activity.

Individuals include citizens of a given country, foreign citizens, stateless persons who act in the economy as independent figures , have the right to personally carry out certain business transactions , regulate economic relations with other persons and organizations , enter into relations with legal entities .

An individual acts on his own behalf and does not need to establish and register a company or enterprise, which is necessary for legal entities.

We examined the concept of what constitutes a legal entity. Is it possible to indicate in a similar way those features that characterize an individual? It may seem that, although such a concept is intuitive, it is rather difficult to clearly define it.

In a sense, you can say that. But, since it is the legal side that interests us, let's see what an individual is from the point of view of the legislation of the Russian Federation.

This definition is based on two fundamental concepts. It's about empowerment and capacity. What are we talking about here?

Legal capacity- this is the ability of a person to be the subject of various civil relations and to bear the corresponding duties. Usually, any adult person has such legal capacity automatically.

legal capacity slightly different from this concept. Here we are talking about the ability to create their rights and obligations and use them.

The main features of an individual

If we compare with the signs of legal entities, we can note the following:

- An individual has a name.

- It does not require a company registration procedure.

- has the right to join economic relations both legal entities and individuals.

- The legal capacity of an individual means that he has the right to conclude transactions, sign contracts, and conduct business activities.

If we analyze the differences and consider them carefully, we can say the following.

- An individual is born and receives his rights and obligations in a natural way. Jur. A person must go through the registration procedure and act on the basis of constituent documents.

- Legal capacity and legal capacity A person arises at the time of registration. Phys. a person receives them depending on age and other factors.

- The number of participants also varies. Jur. a person is always a collective, while an individual acts in the singular.

- Various business risks. In the event of financial obligations, an individual is liable with all his property. For a legal entity, the situation is different. Usually his liability does not exceed the funds of the firm. Although in some cases the liability may be greater.

- The purposes of creating an individual and a legal entity are different. No justification is required here.

Sole Proprietor is a natural or legal person

Individual entrepreneur (IP) - an individual registered in the manner prescribed by law and carrying out entrepreneurial activities without forming a legal entity. To participate in such activities, you need to go through state registration and fulfill all the necessary rights and obligations provided for by law.

However, there are various options for this. They, in particular, differ in the extent of liability provided for in a particular case. And also the degree of how difficult it is to get state registration is important. Indeed, in each case, a certain minimum is provided for this. statutory fund, which can vary greatly depending on the choice made.

For many, starting their own business is a very difficult step. At the same time, in fact, this is a step into the unknown. In such a situation, the easier it is to carry out state registration, the better. From this point of view, becoming an individual entrepreneur is the most convenient choice.

It is much easier to go through state registration for this and requires much less investment than when creating a legal entity. But this simplicity comes at the price of a sharp increase in responsibility for meeting one's financial obligations. Unlike a legal entity for an individual entrepreneur, such liability exists in full.

The debtor - a legal entity, in the most extreme case, risks losing all the property of the company, an individual may lose everything he has. This back side that entry into the business requires minimal costs.

Let's see what's different a common person from an individual entrepreneur. First of all, the fact that the latter is engaged in entrepreneurial activities. In this case, a citizen is required to undergo the appropriate state registration in order to be eligible. In short, entrepreneurial activity is a systematic activity for the purpose of making a profit.

What is legal status individual entrepreneur? According to the wording of the law, this is an individual who has passed state registration and is engaged in entrepreneurial activities without forming a legal entity. Although, in fact, this is an individual, in fact, this concept combines both some features of an individual and some features of a legal entity. Let's look into this in more detail.

Features of the occurrence of the dual position of IP

Here it must be emphasized that in Civil Code of the Russian Federation It is stated that the same provisions that govern the activities of legal entities apply to individual entrepreneurs. Despite the foregoing, in the legislation, the laws themselves often clearly define the delimitation of individual entrepreneurs in their wording. The difficulty for understanding creates, rather, the very fact of combining the nature of both in one category.

Cases when an individual entrepreneur can act as a legal entity

In some matters, an individual entrepreneur can act like a legal entity. We list such situations.

- Possibility to hire workers. Fundamentally, there is nothing special.

- The ability to open a bank account and use it to conduct business.

- Can use the seal to certify the contracts he concludes. (In principle, this is optional).

- Has the right in many cases to engage in many types of economic activity just like a legal entity. Although, this is not always possible. It may also be that an individual entrepreneur has the right to engage in a certain specific type of activity, but a legal entity does not. An example of this would be private security work.

Sometimes an individual entrepreneur has the opportunity, when entering into certain economic or civil relations, to decide whether he will act in the status of an individual entrepreneur or as an ordinary individual. There may be a difference, for example, in the amount of taxes paid.

Responsibility of individual entrepreneurs

The ease of registration and simplified requirements for individual entrepreneurs from the side of the legislation have a downside in that the degree of responsibility on their part is quite high. If the business fails, then the legal entity will be liable only in an amount that does not exceed the property of the company.

An individual entrepreneur will be forced to answer with all the property he has. Of course, in fact, there is a list of what he is obliged to leave (this list includes, in particular, his apartment, provided that this is his only home).

You also need to remember that this is not only about unpaid invoices to suppliers. The amount of debt may also include administrative fines for violations that were committed in the course of economic activity. These may include, for example, the following amounts.

- Penalty for late submission of tax return.

- Penalty for late payment of taxes to the budget.

- Penalty for late reporting to the tax office about opening or closing a bank account.

- Penalty for submitting false information to the state statistics authorities.

- Penalty for illegally conducting the sale of goods (without providing data on the manufacturer of the product).

- Punishment for trading without the use of cash registers.

When recovering money in a lawsuit filed by creditors, the actions take place as follows.

- From the very beginning, the financial resources of an individual entrepreneur, which are stored on his current account, are written off.

- If these funds are not enough, then the property of the debtor is described and confiscated.

- If the personal property of the debtor is still insufficient for the final settlement, then the property of the spouse is described and confiscated.

The possibility of collecting the debt remains for three years after the closure of the activities of the IP. This is in line with the statute of limitations.

Is there an opportunity for an individual entrepreneur to protect his property in the event that similar situation? To do this, you can either not have your own property at all or draw up such a marriage contract that will not make it possible to foreclose on the property of a spouse.

There is also some possibility of criminal liability. This is possible in the following cases.

- Deliberate misrepresentation of accounting data. This is commonly referred to as "double bookkeeping".

- Fraud of all kinds.

- Systematic non-payment or simply delay in paying salaries to their employees.

- Illegal use of a trademark.

- Conducting activities without a license in the event that its need is provided for by law.

- Some other situations.

Individual entrepreneurship gives a number of advantages in business, but at the same time determines strict responsibility for the results of its activities.

The most popular organizational form of commerce is an individual entrepreneur. Taking into account the peculiarities of the industry specifics of the activities of the IP, as well as organizations, they have the right to perform a number of legal actions: to hire employees, open bank accounts, conclude contracts, etc. In this regard, many people have a completely logical question: is an individual entrepreneur a legal entity or an individual? To substantiate the answer, we turn to the norms of the current legislation of the Russian Federation.

What does the term entrepreneur mean?

The term individual entrepreneur of the Civil Code of the Russian Federation is interpreted as an opportunity to conduct legal activities from the moment state registration in control bodies (Stat. 23 of the Civil Code). Obtaining the status is formalized in the Federal Tax Service at the place of residence of the citizen. The registration procedure is regulated by Law No. 129-FZ of 08.08.01.

Figuratively speaking, an individual entrepreneur is an individual who has a legitimate registration number in the Unified Register, who, at his own peril and risk, conducts independent activities with regular profit. Other names for an ind entrepreneur are PE ( self employed) and PBOYuL (entrepreneur without forming a legal entity). As it becomes clear, the opening of a business does not imply the creation of a legal structure for the plan of LLC, JSC, NPF, etc., but it means securing an official status for conducting individual commercial activities and paying mandatory taxes and fees in favor of the state.

Separately, it should be noted that the legal work of an individual entrepreneur has nothing to do with illegal trade. It should also be borne in mind that one-time transactions are not recognized as entrepreneurship and do not require official registration of an individual with tax and other authorities. To become an SME (subject of small business), having issued the status of an individual entrepreneur, every citizen has the right, subject to the following restrictions:

- The individual must be of legal age, i.e. over 18 years of age.

- A minor citizen can open an individual entrepreneur upon reaching the age of 16, subject to entering into a legal marriage or with the consent of guardians (parents).

- At the time of registration, a citizen must have permanent or temporary registration on the territory of the Russian Federation, the fact of citizenship does not matter - both a Russian citizen and a foreigner can become an IP.

Note! It is forbidden to register individual entrepreneurs for civil servants, as well as municipal ones - deputies, judges, officials, employees of the Ministry of Internal Affairs, Internal Affairs Department, prosecutors, etc.

Common features of individual entrepreneurs and legal entities

Since we have already found out that an individual entrepreneur is an individual with an officially registered legal status, it is logical to assume that, along with organizations, entrepreneurs have their own rights and obligations. What do they consist of? We list the main similarities between individual entrepreneurs and companies-legal entities:

- An individual entrepreneur has the right to hire workers under labor contracts with making entries about the length of service in work books, payment wages, providing vacation pay, sick leave and other guarantees under the Labor Code.

- Calculation and subsequent transfer of income tax and insurance premiums from personnel income.

- Calculation tax base depending on the working regime of taxation and payment of the amounts of accrued taxes and fees.

- Preparation of reports to social funds, IFTS, statistical authorities.

- The right to open a bank account - unlike legal entities, entrepreneurs can open bank accounts at will.

- Production of seals and stamps.

- Conclusion of contracts with counterparties - as well as legal entities, individual entrepreneurs can draw up contracts in writing listing the essential terms of transactions.

Differences between sole proprietorship and enterprises:

- The amount of property liability - LLC is liable for obligations only within the amount of the authorized capital. At the same time, each founder of the company is liable in proportion to the size of his share, and the entrepreneur alone risks all personal property, with the exception of certain objects listed in the Code of Civil Procedure of the Russian Federation.

- Registration address - the creation of a legal entity is possible at a legal address, an individual entrepreneur is registered with the Federal Tax Service strictly at the place of residence (temporary or permanent).

- Types of activity - the OKVED list for LLCs is much wider than for individual entrepreneurs. For example, it is forbidden for an entrepreneur to sell alcohol, except for beer.

- The amount of insurance premiums payable - an individual entrepreneur is obliged to transfer fixed amounts annually, regardless of the actual conduct of business or downtime.

- Available tax regimes - an LLC cannot use the PSN, which is allowed for use only by individual entrepreneurs.

- Disposal of income received - it is easier for an individual entrepreneur to use money and at the same time no additional taxes need to be paid, while in an LLC the founder is obliged to pay 13% of dividends in order to withdraw funds from profits.

- Accounting - according to Law No. 402-FZ of December 6, 2011, individual entrepreneurs should not keep accounting (Article 6), and legal entities are obliged and for lack of accounting they are fined under the Tax Code of the Russian Federation.

Signs of an individual entrepreneur

Despite the fact that the legislation of the Russian Federation clearly defines the obligation of individuals to undergo official registration in order to conduct activities, many citizens do not comply with the established regulations and work “in the black”. Nevertheless, inspection bodies pay close attention to illegal immigrants and it is recommended to officially open a business in order to avoid problems and punishment.

Among the signs of IP in 2017, it should be noted: regular trade in goods or the provision of various services (performance of work), the involvement of employees for informal work, the systematic conclusion of contracts with other individuals and enterprises, "gray" cash payments. Also, confirmation of illegal activity is the presence of internal reports indicating the dates and amounts of payments / receipts - the “black” cash desk.

Note! At individual form entrepreneurship, an entrepreneur undergoes a simplified registration procedure, which takes 3 working days according to Law No. 402-FZ.

In what cases is an individual entrepreneur a legal entity?

So, we figured out that the concept of an individual entrepreneur means an individual registered in an approved manner. This is also confirmed in stat. 11 of the Tax Code, that is, the norms of the tax legislation of the Russian Federation. And stat. 2 of the Civil Code defines entrepreneurial activity as one that is carried out systematically, with profit and at one's own risk, that is, with the full responsibility of an individual.

Thus, summing up all of the above, we can state that an individual entrepreneur and a legal entity are two completely different legal and organizational forms, each of which has its own own shortcomings as well as merits. Before you set sail and discover own business, you must carefully read the regulations of the Russian Federation in order to choose best option conducting commercial activities. However, are there situations when it can be noted that an individual entrepreneur is a legal entity? Or rather, that the IP acts on a par with legal entities?

Of course, such cases are possible and the point is not at all in national illiteracy, but in the real norm of the Civil Code, or rather, paragraph 3 of Art. 23 of the Civil Code, which states that the same requirements of civil law that apply to legal entities can apply to entrepreneurship, unless otherwise approved in other legal acts / laws. In practice, this means that individual entrepreneurs, as well as enterprises, are often subject to equal requirements from the Federal Tax Service, social funds, labor inspectorates, statistics agencies and other government agencies. Entrepreneurs have to defend their rights, for example, on the lack of calculation of the cash limit, with the help of lengthy proceedings and complaints to higher authorities. What to do?

First of all, it must be remembered that at certain points an individual entrepreneur must act on a par with a legal entity. This happens when registering hired employees, when accruing taxes from objects of taxation, when opening bank accounts, when issuing primary documents and observing the rules of document flow, etc. In addition, and in accordance with the norms of tax legislation, the use of any of the available taxation systems obliges an individual entrepreneur, acting or acting, to calculate taxes on income received and submit relevant reports - declarations, calculations, etc.

In other cases, of course, the individual entrepreneur does not act as a legal entity, but on his own behalf, that is, as a citizen. And the measures of responsibility applied to individuals are much softer than those established for organizations. An exception is the personal property liability of an entrepreneur for obligations arising in the course of activities.

Conclusion - in this article we told whether an individual entrepreneur is an individual or a legal entity. Additionally, the main differences and similarities between enterprises and individual entrepreneurs are indicated, the signs of entrepreneurship are considered. In conclusion, it is worth noting that in Russia an entrepreneur is a person who, taking into account economic risks, is able to extract regular profits while carrying out legal activities and in compliance with current legislation.

The legal status of an individual entrepreneur raises many questions. First of all, it is not clear to many that an individual or legal entity is an individual entrepreneur from the point of view of legislation.

We will tell in the article what the tax authorities think about this and how individual entrepreneurship is characterized by law.

○ Concept Individual Entrepreneur.

From the point of view of legislation, an individual entrepreneur is not a legal entity. This follows from the definition.

Art. 11 of the Tax Code of the Russian Federation:

Individual entrepreneurs - individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity, heads of peasant (farmer) households. Individuals engaged in entrepreneurial activities without forming a legal entity, but not registered as individual entrepreneurs in violation of the requirements of civillegislation of the Russian Federation, in the performance of the duties assigned to them by this Code, are not entitled to refer to the fact that they are not individual entrepreneurs.

In accordance with this text of the legislation, an individual entrepreneur is a natural person who conducts commercial activities. This is quite clear. However, the legal status of an individual entrepreneur implies a certain similarity with the status of a legal entity. Let's look further at the similarities and differences between these concepts.

○ Signs of individuals and legal entities.

An individual is a person who has rights and obligations within the legal regulation states. An individual has certain characteristics:

- Identification is carried out by full name.

- There is no need for additional registration, except for obtaining a birth certificate and a civil passport.

- The right to carry out economic transactions with other persons and organizations.

A legal entity is an organization registered in the register and having separate property, which is responsible for its obligations.

Art. 48 of the Civil Code of the Russian Federation:

- A legal entity is an organization that has separate property and is liable for its obligations, can, on its own behalf, acquire and exercise civil rights and bear civil obligations, be a plaintiff and defendant in court.

- A legal entity must be registered in the unified state register of legal entities in one of the organizational and legal forms.

- Legal entities, on the property of which their founders have real rights, include state and municipal unitary enterprises as well as institutions.

Legal entities have the following characteristics:

- The presence of registration in a single register.

- Certain property owned.

- Separate name and registered address.

- The presence of a structured team with managers and subordinates.

- The right to obtain licenses for certain activities that are not available in other forms.

- Mandatory presence of a seal and a bank account.

A legal entity is responsible for conducting activities with its property. This sign is identical to the responsibility of an individual and an individual entrepreneur.

○ Comparison of an individual entrepreneur and a simple individual.

In fact, an individual and an individual entrepreneur have many common features. However, conducting certain types of entrepreneurial activity without registration is not allowed. We will tell you what are the similarities and differences between an individual entrepreneur and an individual.

✔ General signs.

Common facts include the following:

- Legally, individual entrepreneurs and individuals are equal.

- This is a specific person with a full name and identification number.

- The place of permanent registration is the same.

- An individual entrepreneur can act as a citizen when concluding transactions.

- Individuals and individual entrepreneurs have the right to conduct business transactions, conclude transactions, draw up the necessary documents and perform legally significant actions.

- In the event of a debt, individuals and individual entrepreneurs are liable with the property they own.

From the point of view of legislation, an individual entrepreneur is the status of an individual. However, there is still a difference between these concepts.

✔ Features.

The difference between an individual entrepreneur and an individual lies in the system of income taxation and the permissible field of activity. For example, an individual with the status of an individual entrepreneur cannot be an employee and at the same time conduct entrepreneurial activities. A person, being an individual entrepreneur, can be an employee, but as an individual.

Many types of commercial activities are not available to an individual who does not have the status of an individual entrepreneur. So, for example, he cannot open a pavilion and sell any goods there or engage in the provision of household services to the population.

○ Comparison of individual entrepreneur and legal entity.

Quite often you can find the identification of the status of an individual entrepreneur and a legal entity. This is not entirely correct from the point of view of legislation, but nevertheless, there are certainly similarities between these statuses. Let's take a look at the similarities and differences.

✔ Commonality in activity.

The commonality of activity lies in the following factors:

- The purpose of the establishment is to conduct business and make a profit.

- The need to pass the state registration procedure.

- Availability of taxation systems - simplified tax system, UTII, etc.

- The possibility of employment of employees in accordance with the Labor Code of the Russian Federation.

- May have a bank account (not required for individual entrepreneurs).

- In court, there can be a plaintiff and a defendant.

This is where the similarity ends. Consider the difference between individual entrepreneurs and legal entities.

✔ distinctive characteristics.

The main differences are as follows:

- An individual entrepreneur is a specific person, a legal entity is an organization.

- Registration of a person as an individual entrepreneur is carried out at the place of permanent residence, and a legal entity is registered at the legal address.

- An individual entrepreneur operates independently, a legal entity is a team of people (however, both of them can be employers).

- The property of the organization and its founders is separated from each other, the individual entrepreneur, in turn, is liable with all his property, as an individual.

- IP does not have its own name.

- A legal entity is required to have a seal and a bank account, for individual entrepreneurs, both are advisory in nature.

- The activity of a legal entity is impossible without the availability of statutory documents.

Organizations have the right to conduct commercial activities in any area that does not contradict the law. Entrepreneurs are subject to certain restrictions.

Individual Entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYuL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact having many of the rights of legal entities. Rules apply to individual entrepreneurs civil code regulating the activities of legal entities, except when separate articles of laws or legal acts are prescribed for entrepreneurs. ()

Due to some legal limitations (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

In case of gross violations or when working without a license - up to 8,000 rubles. And, possible suspension of activities up to 90 days.

From 0.9 million rubles for three years, and at the same time the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit's salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amount of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Art. 198, clause 3. of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Art. 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles for three years, and at the same time, the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit's salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of tax (fee) amounts

1. Non-payment or incomplete payment of tax (fee) as a result of understatement of the tax base, other incorrect calculation of the tax (fee) or other unlawful actions (inaction) shall entail the collection of a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for by paragraph 1 of this article, committed intentionally, entail the collection of a fine in the amount of 40 percent of the unpaid amount of the tax (fee). (Article 122 of the Tax Code)

penalties

If you are only late in paying (but not providing false information), then there will be penalties.

Penalties are the same for everyone (1/300 multiplied by the key Central Bank rate per day of the amount of non-payment) and are now somewhere around 10% per annum (which is not very much in my opinion, given that banks provide loans at least at 17-20%). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after obtaining a license or permissions. The licensed types of activities of individual entrepreneurs include: pharmaceutical, private detective, transportation of goods and passengers by rail, sea, air, and others.

An individual entrepreneur cannot engage in closed activities. Such activities include the development and / or sale of military products, the circulation of narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic products. An individual entrepreneur cannot be engaged in: the production of alcohol, wholesale and retail alcohol (excluding beer and beer-containing products); insurance (i.e. being an insurer); activities of banks, investment funds, private pension funds and pawnshops; tour operator activity (travel agent can); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (realization is possible) and some others.

Differences from legal entities

- The state duty for registration of individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not need a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- IP does not have cash discipline and can dispose of the funds in the account as he pleases. Also, the entrepreneur makes business decisions without logging. This does not apply to work with KKM and BSO.

- An individual entrepreneur registers a business only for himself, unlike legal entities, where registration of two or more founders is possible. Sole proprietorship cannot be sold or re-registered.

- An employee of an individual entrepreneur has fewer rights than a hired worker of an organization. And although in the Labor Code, organizations and entrepreneurs are equated in almost all respects, there are still exceptions. For example, when an organization is liquidated, a mercenary is required to pay compensation. When closing an individual entrepreneur, there is such an obligation only if it is spelled out in the employment contract.

Appointment of a director

It is legally impossible to appoint a director in a sole proprietorship. The sole proprietor will always be the main manager. However, it is possible to issue a power of attorney to conclude transactions (clause 1, article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, for individual entrepreneurs, it has been legally possible to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom some powers are delegated directors. For directors of organizations, a large the legislative framework about rights and obligations. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the regional tax office at the place of registration, in Moscow - MI FTS RF No. 46 for Moscow.

Sole proprietors can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from the age of 16, with the consent of parents, guardians; married; adoption of a decision on legal capacity by a court or guardianship authority)

- foreign citizens living in the territory of the Russian Federation

OKVED codes for an individual entrepreneur are the same as for legal entities

Required documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (in 1 copy). Sheet B of Form P21001 must be completed at the tax office and given to you.

- Copy of TIN.

- A copy of the passport with a residence permit on one sheet.

- Receipt of payment of the state duty for registration of an individual entrepreneur (800 rubles).

- Application for the transition to the simplified tax system (if necessary).

An application for registration of an individual entrepreneur and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must provide documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from the Unified State Register of Individual Entrepreneurs (EGRIP)

After registration

After IP registration must be registered with Pension Fund and MHIF, get statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, registering with Rospotrebnadzor.

taxes

IP pays a fixed fee to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. Fixed fee paid regardless of income, even at zero income. To calculate the amount, use the IP fixed payment calculator. In the same place, the CSC and the details of the calculus.

An individual entrepreneur can apply tax schemes: STS (simplified), UTII (imputation) or PSN (patent). The first three are called special modes and are used in 90% of cases, because. they are preferential and simpler. The transition to any regime occurs voluntarily, upon application, if you do not write applications, then the OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (with OSNO). Another difference is that only entrepreneurs can apply PSN. Also, IP does not pay 13% of personal profit in the form of a dividend.

The entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit accounting reports (only the balance sheet and the report on financial results). This does not exclude the obligation to keep tax records: declarations of the USN, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Of the inexpensive programs for individual entrepreneurs, one can single out with the possibility of submitting reports via the Internet. 500 rubles / month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult to get a loan from a bank for an IP business than a legal entity. Many banks also give mortgages with tension or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but they do not allocate profit there. Patent and UTII are especially opaque in this matter; these systems do not even have income records. USN "Income" is also unclear, because it is not clear how many expenses. USN "Income-Expenses", ESHN and OSNO most clearly reflect the real state of the IP business (there is a record of income and expenses), but unfortunately these systems are used less frequently.

- An individual entrepreneur himself (unlike an organization) cannot act as a pledge in a bank. After all, he is a natural person. The property of an individual can be pledged, but it is more difficult legally than a pledge from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, leaving all business, etc. And if in an organization you can change the director and founders at the click of a finger, then the IP in this case can only be closed, and the loan agreement can be terminated or go to court. IP cannot be reissued.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing plans to spend money. Consumer loans usually have high rates, but not always. Especially if the client can provide a deposit or he has a salary card in this bank.

Subsidy and support

In our country, hundreds of funds (state and not only) provide advice, subsidies, soft loans for individual entrepreneurs. In different regions - different programs and help centers (you need to look). .

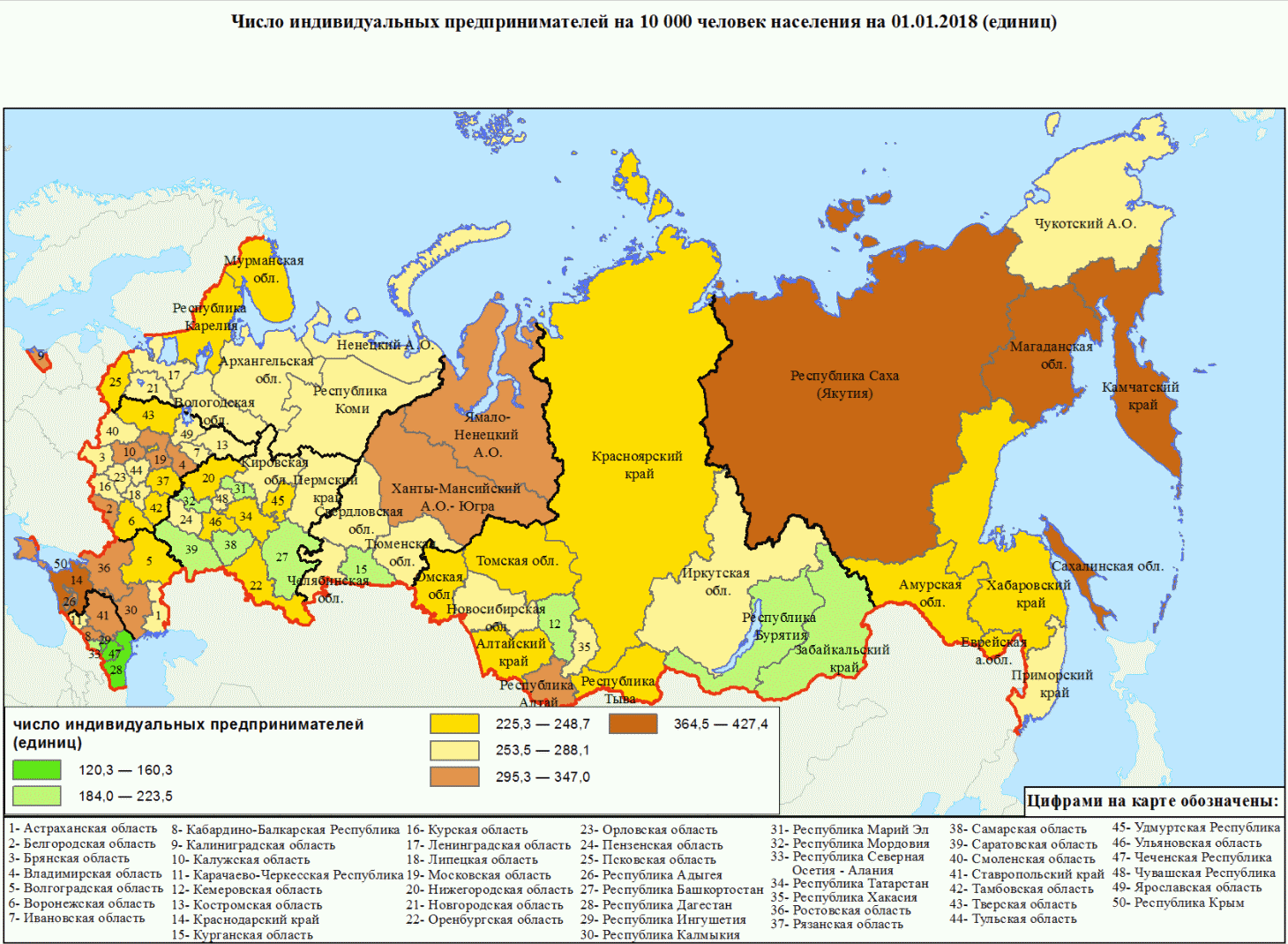

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Retirement experience

If the entrepreneur pays everything to the Pension Fund regularly, then the pension period goes from the moment of state registration until the closure of the IP, regardless of income.

Pension

Under current legislation, an individual entrepreneur will receive a minimum pension, regardless of how much he pays to the FIU.

The country is undergoing an almost continuous pension reform, and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then he will not have pension indexation.

Insurance experience

The insurance period for the FSS goes only if the entrepreneur voluntarily pays social insurance contributions (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur. It is accepted only for employees. IP, unlike the director, does not apply to mercenaries.

Theoretically, an individual entrepreneur can hire himself, assign a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because. Then you have to pay all payroll taxes.

Maternity can only be received by a woman entrepreneur and only on condition of voluntary insurance in social insurance. .

Allowance up to one and a half can be received by any businessman, regardless of gender. Either in RUSZN or in the FSS.

IP leave is not allowed. Because he has no concept of working time or rest time and production calendar also does not apply to it.

Sick leave is only for those who are voluntarily insured with the FSS. Calculation based on the minimum wage, the amount is insignificant, therefore, in social insurance, it makes sense to insure only mothers for maternity.

closure

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

IP closing happens in the following cases:

- in connection with the adoption by an individual entrepreneur of a decision to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court order: by force

- in connection with the entry into force of a court decision deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (delay) confirming the right of this person to reside in the territory of Russia;

- in connection with the adoption by the court of a decision on the recognition of an individual entrepreneur as insolvent (bankrupt).

Databases for all IPs

Contour.Focus website

Partially free Contour.Focus The most convenient search. It is enough to enter any number, surname, name. Only here you can find OKPO and even accounting information. Some information is hidden.

USRIP extract on the website of the Federal Tax Service

For free Federal Tax Service database EGRIP information (OGRNIP, OKVED, PFR number, etc.). Search by: OGRNIP / TIN or full name and region of residence (patronymic name is not required).

Bailiffs Service

For free FSSP Learn about enforcement proceedings for the collection of debts, etc.

With the help, you can keep tax records on the simplified tax system and UTII, generate payments, 4-FSS, Unified settlement, SZV-M, submit any reports via the Internet, etc. (from 325 r / month). 30 days free. On first payment. For newly created IPs now (free of charge).

Question answer

Can I register on a temporary basis?

Registration is made at the address of permanent residence. To what is indicated in the passport. But you can send documents by mail. By law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent residence permit in the passport (provided that it is more than six months old). You can conduct business in any city of the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in the labor himself?

An entrepreneur is not considered an employee and does not make any entries in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude with himself employment contract, make an entry in work book and pay deductions as for an employee. It's unprofitable and makes no sense.

Can an IP have a name?

An entrepreneur can choose any name for free, which would not directly conflict with the registered one - for example, Adidas, Sberbank, etc. In the documents and in the plate on the door, there should still be an IP full name. He can also register a name (register a trademark): it costs more than 30 tr.

Is it possible to work?

Can. At what you can not report at work that you have your own business. It does not affect taxes and fees in any way. Taxes and fees of the FIU must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two sole proprietorships?

IP is just the status of an individual. It is impossible to become an IP twice at the same time (get this status if it already exists). TIN is always the same.

What are the perks?

There are no business benefits for the disabled and other privileged categories.

Some commercial organizations also offer their discounts and promotions. Online accounting Elba for newly created IP is now the first year as a gift (free of charge).